Taxation on the employment income of workers considered to be Non-Resident in Spain is governed by the law popularly known as the “Beckham Law” and officially known as the “tax regime for expatriates”.

This law has been the focus of attention and controversy in Spain since it was introduced in 2005. This special tax regime was originally designed to attract highly qualified professionals, including foreign sportsmen and women, with the promise of significant tax benefits. Over the years, the law has been changed and reformed,

creating many doubts in the process. In this article, we will take a close look at the Beckham Law and focus on the key issues around it from the perspective of payroll.

First, we should draw a distinction between 3 concepts which, although similar, are not the same:

- Non-resident

- Non-resident covered by the Special Non-Resident Regime (Beckham Law)

- Tax Resident

1. What is the Beckham Law and what is its origin?

The Beckham Law, which bears the name of the famous British footballer David Beckham, was created to attract foreign talent to Spain.

It offered expatriates substantial tax benefits, including taxation at a flat rate of 24% on income earned in Spain during the first five years of residency. This meant that

expatriates only paid tax on a part of their income, which resulted in a considerably lower tax burden in comparison with normal tax residents in Spain.

2. When is a person considered a Non-Resident for tax purposes in Spain?

- When they remain in Spain for less than 183 days during a calendar year.

- When the core business of their activities or economic interests is not directly or indirectly located in Spain.

- When the spouse and non-minor children dependent on that natural person do not usually live in Spain.

3. Are there different types of Non-Residents?

Yes, a distinction should be drawn between Non-Residents and Special Non-Residents.

Non-Residents. There are two types in this category:

o EU

o NON-EU

In these two cases, the law is temporarily applied until one of the 3 requirements mentioned above no longer holds, usually because the person remains in Spain for more than 183 days. That is to say, a worker can begin their employment relationship with a company as a Non-Resident, and then their status can change to Resident during the same tax year, whereupon the criteria outlined in our previous article on IRPF (Personal Income Tax) are applied to them.

Special Non-Residents:

Subsequent to a request made to Agencia Tributaria (the Spanish tax authority) by means of a specific official form, and having demonstrated that all the requirements are met, the authorities will recognise and certify that this natural person can apply the Non-Residents law for a maximum period of 5 years.

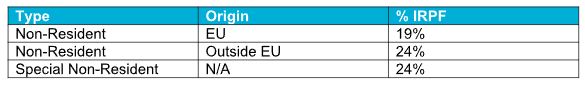

4. Is the retention percentage the same for all Non-Residents?

No, it will depend on where the worker is from.

Workers from the European Union will be taxed at 19% on their Retention base, provided that they are not Special Non-Residents.

Workers from outside the EU will be taxed at 24%.

Special Non-Residents, regardless of their country of origin, will be taxed at 24%.

5. Is there any limit on the Taxable base?

Yes, those earning more than €600,000 a year will be taxed at 47% on income above this amount.

6. Are pension plans affected by the Beckham Law?

Taxpayers covered by the Beckham Law are not exempt from paying tax on contributions to pension plans. Tax benefits associated with pension plans in Spain are applied in accordance with general tax regulations, independently of the tax regime to which taxpayers are subject.

7. And finally, how does the Beckham Law affect Non-Residents’ Maternity/Paternity benefit?

Parents who are covered by the Beckham Law are not exempt from paying tax while they are on maternity/paternity or adoption leave. Maternity and paternity leave in Spain is independent of special tax regimes such as the Beckham Law. Maternity/paternity and adoption leave benefits are based on Social Security contributions paid and are in line with the regulations in force.

If you still have any doubts or you need some advice, please do not hesitate to contact our experts. We offer a range of business consultancy services and we will be delighted to offer you guidance on any steps you may need to take in Spain.